Why Zynga's Real-Money Gaming Opportunity Is Smaller Than The Bulls Believe - Seeking Alpha

[Note from Geiger: So, Moreno's analysis is clearly misguided and incorrect but it is a good example of how most folks do not understand at all the online gaming/gambling market]

This is the final article in my three-part series on Zynga (ZNGA). In this article, I'll explore the potential incremental value to Zynga shareholders from the firm moving into real money gaming (basically gambling games with real money). To the best of my knowledge this is the only attempt I've seen to quantify the impact to shareholders.

One of the blue-sky opportunities that Zynga is exploring is to begin offering real money games in addition to its play money games. Essentially, the firm could take some of its existing games like poker, slots, bingo, and/or blackjack and give the user the opportunity to wager real money for real payouts-basically an online casino. As online gambling is already legal in parts of Europe, you can expect that area to be the first geography the firm focuses on. And while online gambling is currently illegal in the US, there has been some discussion of legalizing it (at least on a state-by-state basis). In doing research on this opportunity I stumbled upon some great market share data in bwin.party's 2011 annual report and I'll share some of their tables in my analysis below:

Non-US Opportunity

On its 2Q12 earnings call, Zynga noted that it expects to launch its first real money gaming product in existing regulated and open markets in 1H13, subject to licensing approvals. The questions then become how big are these markets, how difficult are they to enter, and what percentage market share can Zynga realistically hope to take. To answer the first question, H2 Gambling Capital estimates that the online poker gaming market (excluding the US) was €2.9b in 2011 and H2 estimates that this market will grow at a 6% CAGR rate through 2015 (€3.6b). To answer the second question on difficulty of enter these markets, we need to examine the regulatory environment. The regulatory environment across Europe is very fragmented with each country having its own regulation and restrictions. This high regulatory hurdle makes it fairly difficult for a new player to enter the market without partnering with an existing provider. In the table below, taken from bwin.party's 2011 annual report, I lay out the current regulatory environment in Europe:

European Regulatory Environment

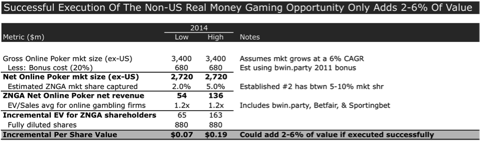

To answer the third question on Zynga's ability to take market share, let's look at the current players. The European online real money poker market is already very well established with the clear market leader being PokerStars, which controls nearly 30-40% of market share. There are then a series of smaller players with between 5-10% market share. The keys to a successful online poker offering are to give players a safe and secure way to make and receive payments (i.e. basically a trusted brand) and player liquidity (i.e. the ability to find an open table at the stakes they want). In my view, obtaining critical mass of real money players is likely to pose the biggest hurdle to Zynga as it tries to enter these markets. As I see it, players that wanted a real money option, already have one, and likely have already established a presence on one of the existing European online poker sites. So while it's possible that Zynga converts some of its existing user-base to real money, I think forecasting anything over 5% market share would be considered very aggressive. It's also worth mentioning that bwin.party just announced that it is investing $50mm in the social gaming space providing additional competition for any new participant entering the market. Furthermore, Gamesys, a Zynga competitor, launched the first real money Bingo game on Facebook in early August 2012. This could potentially mean that other game companies roll out a real money poker game on the Facebook platform prior to Zynga getting the appropriate approvals. With that in mind, in the table below, I run a simple analysis that estimates the potential incremental value to Zynga shareholders from a successful real money gaming launch. Put another way, if you told me with 100% certainty that Zynga would enter these markets and capture 5% market share in 2014, I would expect the stock to jump about $0.20 (or 6%) all else equal.

US Opportunity

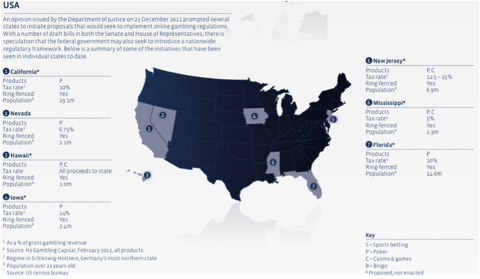

The US opportunity is where I think the real juice could be for Zynga, but this opportunity is highly dependent on a change in regulatory environment, Zynga's ability to execute quickly in a space they're less familiar with, and on other international players with deep player liquidity having limited access to the US. Let's take the same approach to analyze the US market that we used to analyze the non-US market, namely answer the questions, how big is the market, how difficult is it to enter, and what percentage of market share can Zynga realistically hope to capture. To estimate the current 'potential' size of the US online poker market, I need to do a little math based on two data points I was able to track down. I have a 2008 H2 US online poker market estimate of $1.5b and a JPM 2015 estimate of $3.5b to 5.0b. Using these data points and assuming a constant growth rate I can back into an estimate for what the US poker market would be today if it were legal - $2.1b to $2.6b. To examine the ease of entering the US market, we need to understand the current regulatory environment. While online gambling is illegal at a federal level, some states have passed laws to make it legal. This could lead to a very complicated regulatory framework in the US and Zynga has virtually no experience in this arena. Similar to the non-US area, I wouldn't be surprised if Zynga opted to partner with a larger firm more experienced in navigating gambling licensing and regulation. In the US there have been rumors that Zynga might partner with Wynn. Again, borrowing from bwin.party's annual report, I show a table detailing the regulatory framework on a state-by-state basis in the US:

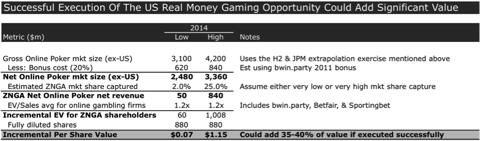

The next step we need to take is to estimate the potential market share that Zynga could capture in the US. Unlike Europe where there are a series of established venues with deep player liquidity, the US is currently a wide-open field and it's possible that some existing international players will not be allowed to operate here. So there is the potential for Zynga to convert existing play money users into real money users. Zynga is far and away the dominant provider of play money poker in the US, but there is significant execution risk. For example, if Zynga can't move quickly enough to get the appropriate regulatory approvals and licenses in place, foreign competitors could come into the market offering deep player liquidity from their established player bases in non-ring-fenced countries. Basically, if Zynga is not one of the first providers, in my view they will lose existing players to other venues and will never capture significant market share in the US. Additionally, given that PokerStars recently settled with the DoJ, if real-money gambling becomes legal again, they should be able to leverage their brand and deep player liquidity abroad to capture significant share in the US. Taking all of this into consideration, I run a similar analysis to what I ran for non-US markets and estimate the potential value of Zynga successfully offering real money games in the US. In a very best case scenario where Zynga captures significant market share and doesn't require a partner to compete, I estimate that the impact could be significant, adding upwards up 35-40% of value to Zynga shareholders. However, let me caveat this analysis by saying that I think at the very least Zynga will need to partner with an existing real money gaming company and that will like cut down on Zynga's benefit dramatically. So realistically, Zynga's upside is likely capped at 15-20% if they are able to successfully execute and capture significant market share in the US.

Risks

There is a fair amount of risk that comes with entering a highly regulated business. In highly regulated businesses, there is a dramatically higher likelihood that the firm could be fined significant amounts of money or face civil and criminal charges for any violations. While partnering with established players in this business could mitigate some of this risk, a partnership will also decrease the size of the opportunity. Additionally, there is also the risk of an image problem. Gambling firms are seen as aiding a vice and if this reflects poorly on Zynga it may hurt their existing business. None of these risks are insurmountable, but should be considered carefully.

Bottom-Line: The non-US real money gaming opportunity is likely smaller than many people realize and the US gaming opportunity,while potentially large, far from a slam dunk.

As I mentioned above this the third article in my three-part series on Zynga, if you're interested, you can read my previous articles here:

As always, your comments and questions are appreciated.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment